GFCU Savings contact

The GFCU Savings call centre hours are open from 7:00am-7:00pm Monday to Friday and 8:00am-4:00pm on Saturday.

Local: 1-250-442-5511

Toll-free: 1-866-442-5511

Email: info@gfcu.com

A financial institution where you matter, where your voice and vote really count, where your interests come far ahead of making profit. That’s what a credit union is. That’s what Gulf & Fraser is.

A financial institution where you matter, where your voice and vote really count, where your interests come far ahead of making profit. That’s what a credit union is. That’s what Gulf & Fraser is.

From personal and business banking to financial advice, Gulf & Fraser exists to help members achieve financial wellness.

Supporting community is at the heart of what we do. Why? Because, as a credit union, we’re rooted in community. We genuinely care about leaving a lasting positive impact on the places our members and employees call home.

Gulf and Fraser Fishermen’s Credit Union began in 1940 as North Arm Credit Union. A small group of people from the commercial fishing industry met in a kitchen and discussed their challenges getting credit from commercial banks. Together they pooled $79.13 to start the credit union. That was the beginning of a long history of coming together to make something better, to bring more choice to the hard working people of BC.

In 1948, we changed our name to Gulf and Fraser Fishermen's Credit Union, and quickly became known as GAFF.

We now refer to ourselves as Gulf & Fraser. Five years later, in 1953, we expanded our boundaries to include any and all fishing industry workers and their relatives in BC. We now welcome all members, regardless of their connection to the fishing industry.

Through our members’ trust in Gulf & Fraser over the years we have joined together with other BC credit unions and created the scale we need to enhance our services, to have a voice in the province, to operate more branches, to make banking easier for you.

In the past two decades, we have joined together with five credit unions:

A significant milestone for Gulf & Fraser included our merger with United Savings Credit Union in 2004. Before joining us, United Savings Credit Union had already merged with 35 other credit unions including Burnaby Savings, City of Vancouver Employees, dairy workers, transportation industry employees, beer workers and many more. Upon joining with Gulf & Fraser, United Savings added Fleetwood, Main Street, New Westminster, and South Burnaby branches to our branch network.

Joining together with Aldergrove Credit Union allowed us to complete a route of branches from West Vancouver through the Lower Mainland and into the Fraser Valley. The merger brought a significant increase in capital and resources and enabled us to hire more employees and enhance our service offering to members—including our Member Rewards Program, inspired by a similar program at Aldergrove Credit Union.

The merger with Mount Lehman Credit Union meant that Gulf & Fraser expanded further into the Fraser Valley with a branch located in the beautiful farmland of Abbotsford.

The merger with VP Credit Union brought people who work in law enforcement into our membership. This merger increased our membership and added to the credit union's capital to allow more investment in technology.

The merger with Grand Forks District Savings Credit Union brought 8,000 members living in Kelowna, Grand Forks and the Boundary Region into Gulf & Fraser. This incredibly engaged membership saw the value in merging and remaining strong for future generations.

This merger allowed Gulf & Fraser to continue to grow and move closer to realizing our goal to create a provincial credit union.

Gulf & Fraser and Interior Savings merge to become a first of its kind, province-wide credit union built from the cooperative values upheld by its founding BC credit unions that have served members since 1939.

It was the vision of our Board that led us to join with our credit union peers and become the strong and vibrant credit union we are today. We are grateful for the foresight and thoughtful planning of our past Board Chairs and Directors.

2009 - 2014 - Vince Fiamengo

2015 -2021 - Lewis Bublé

2022 - December 2023 - Floyd Yamamoto

Chair of United Savings Credit Union (ending 2004) - Ed McIntosh

Chair of Aldergrove Credit Union (ending 2021) – Bev Dornan

Chair of VP Credit Union (ending 2022) – Mario Giardini

Chair of Mount Lehman Credit Union (ending 2022) – Chris Bodnar

Chair of Grand Forks District Credit Union (ending 2023) – Michael Strukoff

Chair of United Savings Credit Union (ending 2004) - Ed McIntosh

Chair of Aldergrove Credit Union (ending 2021) – Bev Dornan

Chair of VP Credit Union (ending 2022) – Mario Giardini

Chair of Mount Lehman Credit Union (ending 2022) – Chris Bodnar

Chair of Grand Forks District Credit Union (ending 2023) – Michael Strukoff

For over 80 years, Gulf & Fraser has been delivering the personal banking, business banking and wealth services that members need to achieve their goals.

We celebrate over 80 years of member service and community support by opening the Gulf & Fraser Hub and a flagship branch in Burnaby.

Our credit union proudly hits a major community milestone – $1 million raised for the United Way of the Lower Mainland.

To improve the member experience, we launch our Member Hub contact centre, LiveChat service and five new branches.

We’re the first credit union in BC to implement Interac® Flash (tap to pay) for all members.

Gulf and Fraser Fishermen’s Credit Union becomes "G&F Financial Group" (G&F).

As online banking revolutionizes the financial experience, our credit union expands rapidly. We merge with United Savings Credit Union and open three new branches in the Lower Mainland.

We open a branch in the Richmond Centre and complete our first merger, joining with Elco Credit Union.

Recognizing the importance of financial advice and wealth services, we launch our financial planning program (now known as the Smart Money Plan™).

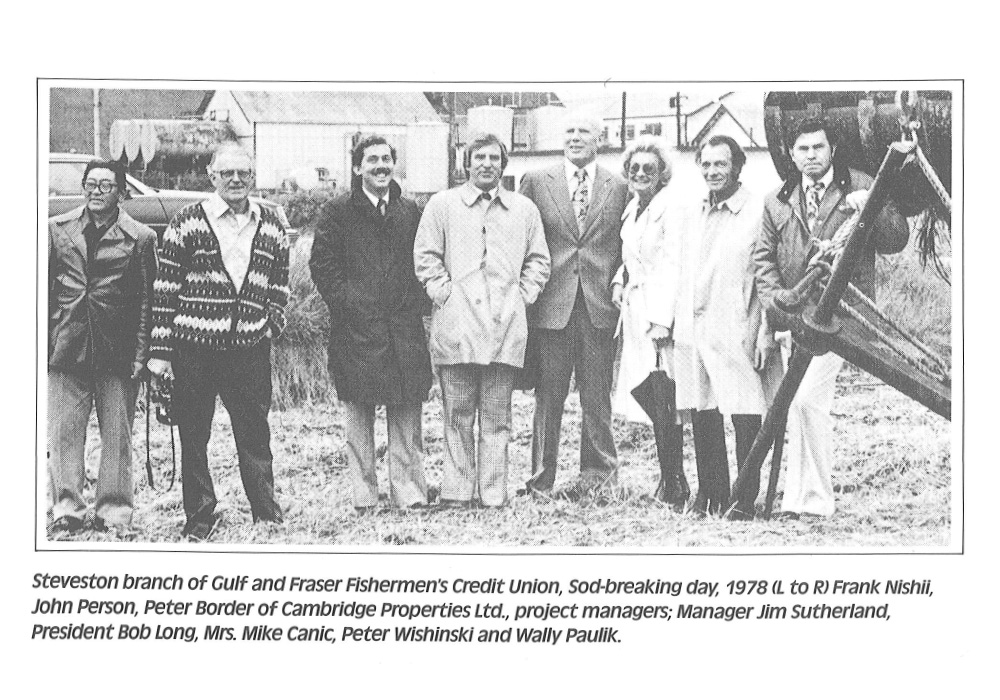

We open to everyone, and our second branch is established in the Steveston community of Richmond.

Proudly trailblazing again, we also provide one of our first mortgages to a financially independent woman.

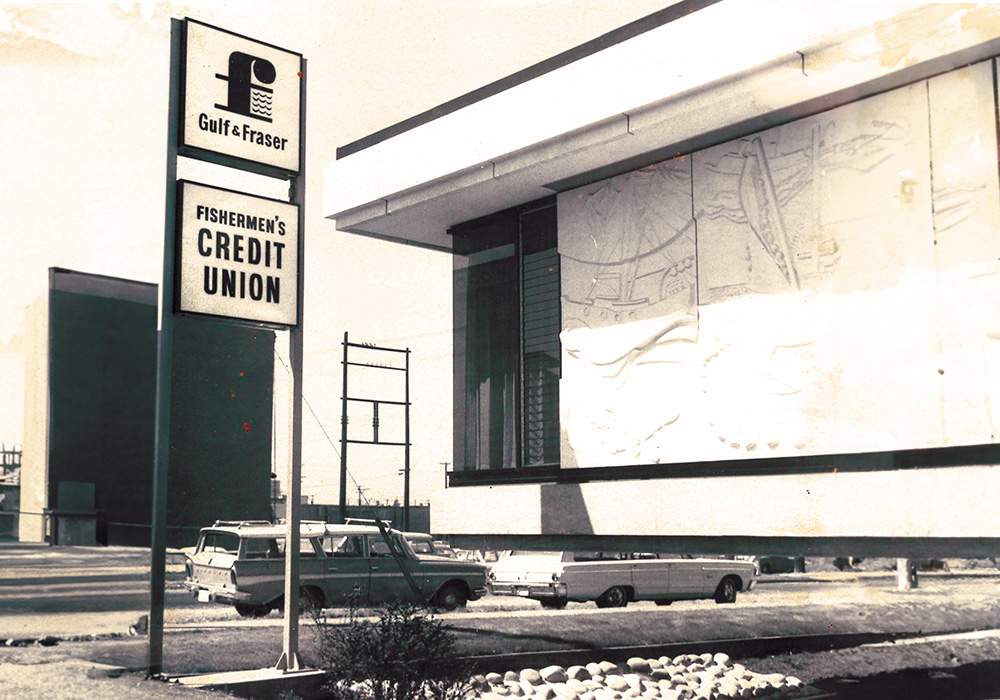

We open our head office and first branch on Hastings Street in Vancouver.

We’re also the first to offer bursaries to UBC and SFU students, establishing an ongoing industry trend of supporting education.

We expand our membership to include everyone in the fishing industry and their families.

Deposits quickly grow, as the first personal chequing accounts give members easier access to their money.

It all begins. BC fishermen open North Arm Credit Union (later named Gulf & Fraser Fishermen’s Credit Union).

Gulf & Fraser Credit Union is led by an experienced executive team and a board of directors chosen by our members.

Looking for a team that empowers growth? A place where you can make a genuine impact? Look no further!

We’re always up to something. Make sure you stay in the know by reading our latest member news.

The GFCU Savings call centre hours are open from 7:00am-7:00pm Monday to Friday and 8:00am-4:00pm on Saturday.

Local: 1-250-442-5511

Toll-free: 1-866-442-5511

Email: info@gfcu.com

©2025 Gulf & Fraser. All rights reserved. Gulf & Fraser and GFCU Savings are trade names of Beem Credit Union.